Max out roth ira calculator

Roth IRA Conversion Calculator. Creating a Roth IRA can make a big difference in your retirement savings.

What Is The Best Roth Ira Calculator District Capital Management

Ad TIAAs IRA Contribution Calculator Can Help Determine Your Contribution Limits.

. For the purposes of this. Ad Learn About Tax Advantages And Contribution Limits. For some investors this could prove to.

But even for those with the means to contribute that amount proper planning can be. Max Out 401K And Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the. To maximize its advantages you need to focus on maximizing your contributions.

198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. For 2022 the maximum annual IRA. The amount you will contribute to your Roth IRA each year.

Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. This calculator assumes that you make your contribution at the beginning of each year. In 2022 the maximum annual contribution you can make for a Roth IRA is 6000 depending on your filing status and modified adjusted gross income MAGI.

Subtract from the amount in 1. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. It is important to.

The amount you will contribute to your Roth IRA each year. In 1997 the Roth IRA was introduced. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

This is only true for people within a certain income range as those who have. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. This calculator assumes that you make your contribution at the beginning of each year.

In 2022 this is 20500 towards a 401 k and 6000 7000 if older than 50 towards a traditional IRA. People with incomes above certain thresholds cannot qualify to make Roth IRA contributions. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Not everyone is eligible to contribute this. This calculator assumes that you make your contribution at the beginning of each year. If youre under 50 in 2022 you.

Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with. Hitting that threshold looks different depending on your age. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Buy Gold Investments from Top US Providers. Roth Conversion Calculator Methodology General Context. For the 2022 tax year the threshold is anything above an adjusted gross income of 144000 up.

Married filing jointly or head of household. For 2022 the maximum annual IRA. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

Keep Your Retirement On Track. Reviews Trusted by Over 45000000. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

The maximum you can contribute to a Roth IRA is 6000 in 2022 7000 if age 50 or older. Max Out 401K And Roth Ira Calculator Overview. 129000 for all other individuals.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

Historical Roth Ira Contribution Limits Since The Beginning

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

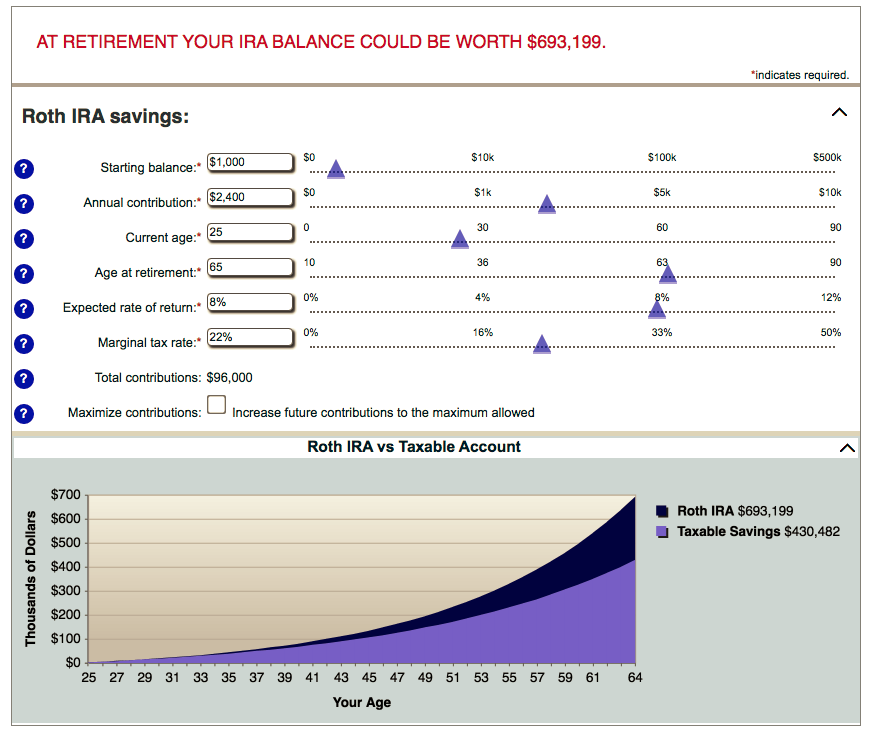

Ira Calculator See What You Ll Have Saved Dqydj

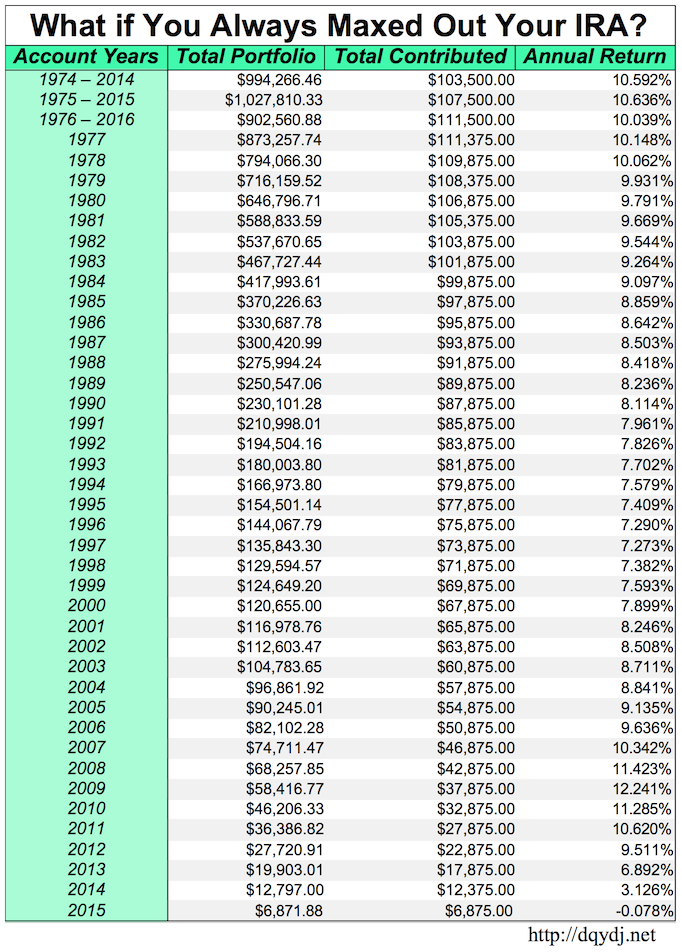

What If You Always Maxed Out Your Ira Seeking Alpha

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

How To Use A Roth Ira Calculator Ready To Roth

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Ira Calculator Roth Deals 52 Off Ilikepinga Com

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

What Is The Best Roth Ira Calculator District Capital Management

Download Roth Ira Calculator Excel Template Exceldatapro

Ira Contribution Deadlines And Thresholds For 2022 And 2023 Smartasset